Enduring partners for visionary founders. We partner with entrepreneurs in the US & India at every stage, for the long-term.

Our approach

WestBridge supports entrepreneurs in the US and India with patient, purpose-driven capital from Series A to IPO and beyond. For over twenty years, we’ve discovered and invested in more than 150 visionary companies, with a nexus to India, across both private and public markets, often as their largest institutional partner.

In addition to long term capital, with investments ranging from Series A to public, we help companies succeed through hands-on portfolio support, deep market expertise, and a strong global network. Our team serves on the boards of many portfolio companies, developing partnerships that span decades. We believe that building great businesses takes time. Enabled by the unique evergreen and crossover structure of our $7 billion fund, the number one commitment we make to founders is to be their partner at each step of the journey.

WestBridge in numbers

$7.3B

Fund size as of September 20245-25

Investment horizon, in years$10-500M

Range of capital investmentsFocus Areas

-

SaaS / AI

Cloud-based, modular, feature-rich software is changing the game for enterprise IT. With Indian SaaS companies performing go-to-market right from home, customer acquisition costs are low and the potential for scaling and value creation is unprecedented.

-

Enterprise / B2B

Enterprise solutions are exponentially streamlining workflows, improving communication and providing access to critical decision-making data increasing the speed and effectiveness of processes like talent recruitment, customer service workflow analysis and logistics management.

-

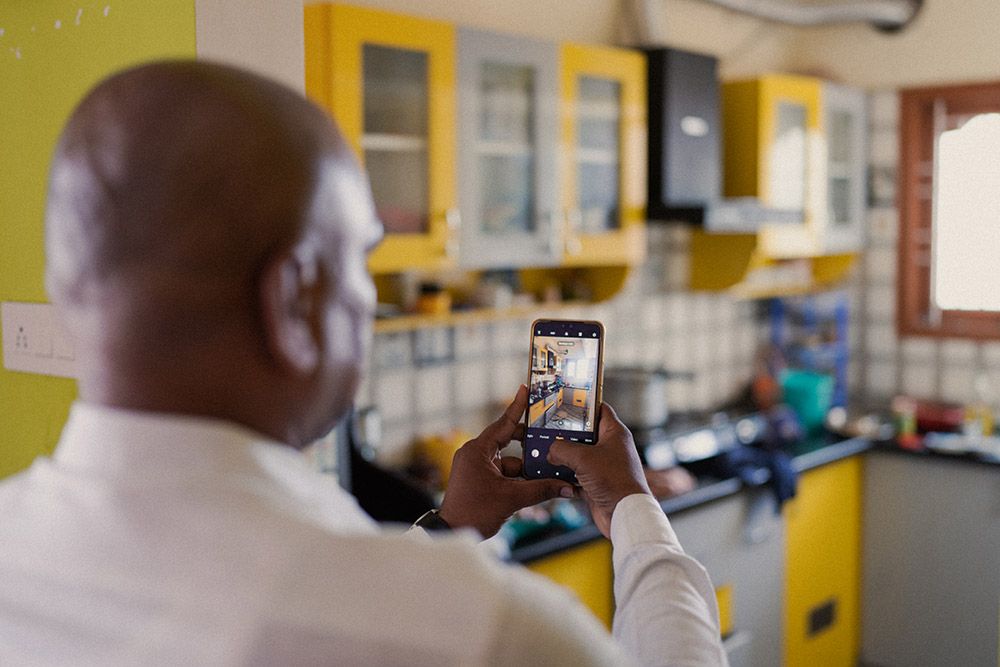

Healthtech

From big data to smartphones, new and legacy providers are leveraging technology to improve healthcare provision, diagnostics and outcomes.

-

Fintech

Our fintech companies are unbundling gate-kept services and driving down costs expanding financial opportunities to the many Indian small businesses, startups and families who are geographically isolated or find traditional banking and accounting providers difficult to access.